banks of the TV, ie. TV banking is not new to banking. The first attempts to introduce such services were already made in the 80s by British and American banks (Teletext). In our market 10 years ago, the service has introduced Invest-Bank. Customer using a decoder gained access to the portal Cyfrowy Polsat Television Interactive, where he was available Invest program account.

The service can be used as passive or assets left. Passive service was available by satellite and modem and allow for information about the account balance, recent transactions and new products offered by the bank. Service active also allowed to perform wire transfers. Of course, at that time it was rather than sector interest channel that clients are actively using it. The service was suspended probably in 2005. Initially was directed mainly to people who do not have internet access at home.

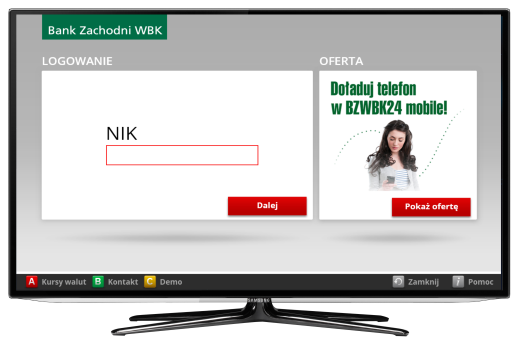

History has come full circle and bankers think back to TV banking. Technological advances have made it possible bankowania with televisions today are incomparable. BZ WBK plans to introduce a banking application running on TVs Samsung’s Smart TV line. This modern devices that connect to the internet and allow you to install special applications. And this program to operate a bank account in the fall will provide customers with BZ WBK. Initially the service will be available only in a passive way – the customer will be able to check the account balance, transaction history, or read a message from the bank. Over time, additional options will be strapped.

BZ WBK development of mobile banking is seen as a strategic direction. The bank has a separate area of ??Mobile and Internet Banking, headed by Thomas Niewiedzia?. The importance of this area in the structures of the bank by the fact that its director reports directly to the President. Interestingly, even in the name of the field in the first place highlights “mobility” and only then “internetowo??”.

must admit that I had serious doubts about the wisdom of introducing services on television, in an era where smartphones and tablets rule the market. These devices are mobile and make the bank have with you 24 hours a day. Why make banking on the devices that are intended to be “grounded” in the living room? The bank enlightened me that the opportunities offered by the banking of talewizorem will serve very different functions than mobile banking. I deliberately use the term “banks” and not the service account, because the service must not be reduced only to manage a bank account. We can imagine a situation that we are watching an ad, say, a vacuum cleaner, and at the bottom of the bank tells us, “you have enough money to buy a product, you want to make a deal?” Click yes and for two days we receive a package from the courier. Or watching a car ad and the TV tells us that our bank offers us from the hand of an auto loan. Thi s may look like the future of banking.

Banker TV studio in Michael Kry?skim speculated about the opportunities and risks they may pose banking TV. I invite you to watch the movie:

What else will be distinguished from modern television pioneer banking services launched years ago, the process control application. Today it is no longer only a pilot, but most of all gestures. The client will move and tapped his finger in the air, and the receiver differentiates between gestures. Owners of the Xbox 360 with Kinect sensor, well aware of what’s going on. We are the remote control and application support looks like straight out of a science fiction movie. Moreover, attempts to use the Kinect has already been taken. Last year, the Lithuanian company Etronika showed how it can look “kinect banking”:

This is the gesture-based control of Samsung Smart TV:

TV Banking based on Samsung TVs has already been implemented in the Canadian Scotiabanku:

Everything indicates that we are on the verge of another revolution in banking. If the solutions implemented by BZ WBK will be well received by customers, further work will be fought for and implemented new features. Maybe in a few years shopping while watching a movie (“I want these shoes!”) Will become commonplace. Of course, this enthusiasm at the moment dampen prices Smart TV receivers, the truth is that over time the price will start to melt away. This vision does not have to be as far as we now may seem. Just look at what technological leap has been made in the last 2-3 years in mobile banking. Today it is easier to find a bank (commercial), which offers access to mobile banking, than that which it does not yet exist. A modern smartphones slowly forcing out traditional cells. Today, every third Pole is in the hands of a smartphone. As these proportions will look like a year or two?

| text comes from the portal PRNews.pl |

|

Wojciech Boczo?

Analyst Bankier.pl

| »BZ WBK getting closer” IKO + “. Single-use codes already in place |

| »Beware of SMS from the bank, the new forms of phishing |

| »silvers surfers will rule, Also on the web |

No comments:

Post a Comment